Trial Balance.

1. Enter Profit and Loss data

2. Balance sheet Data

A) Calculate depreciation on last years net book value (Net Book = Cost – Acculated Depreciation.

b) Add editions for current year

c) Calculate depreciation on current years additions

d) Add together current years depreciation including additions and add this to the balance sheet for current depreciation figure

e) Add the same charge to P&L

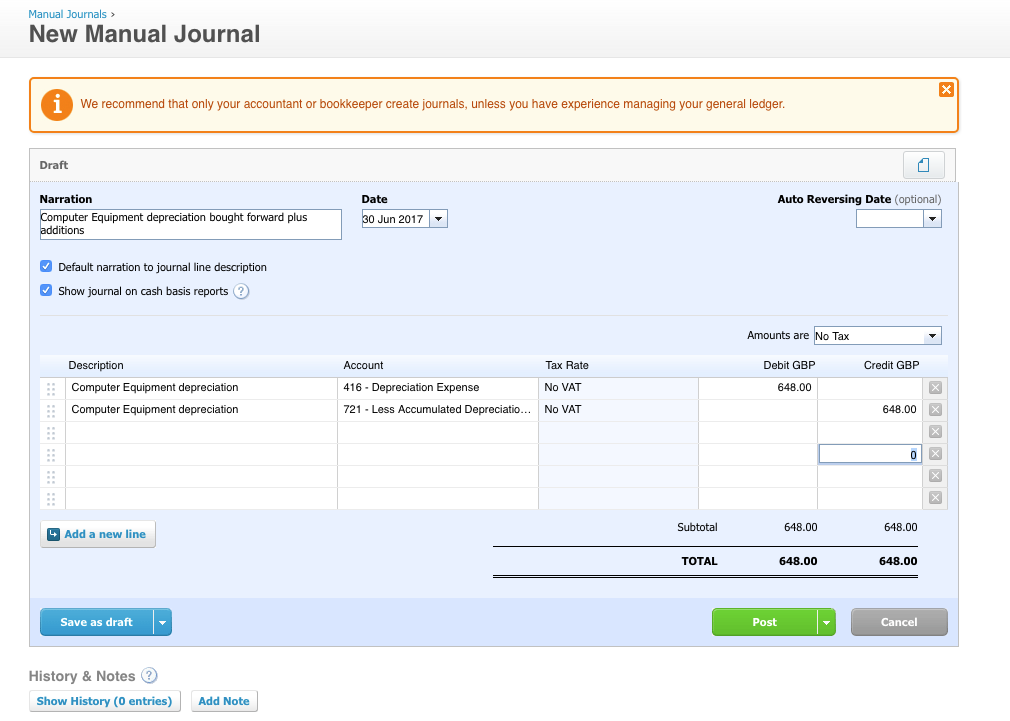

Post Depreciation in Xero

Directors Loan Account

Calculate Owners A Funds Introduced +Directors Loan Account +Owners Drawings